How To Fill 15h Form For Fixed Deposit Sample

Form 15G and Form 15H are self-declaration forms which can be submitted to banks and other institutions to avoid Tax deduction at source (TDS) by banks on fixed and recurring deposit. The post covers the following:

- Who is eligible to submit Form 15G and Form 15H?

- Where can Form 15G and Form 15H be used?

- Step by Step guide to fill the form along with Filled Form 15G Sample & Form 15H Sample

Contents

- 1 Who can submit Form 15G and Form 15H?

- 1.1 Form 15G eligibility

- 1.2 Form 15H eligibility

- 1.3 Scenarios when you can or cannot fill Form 15G or Form 15H

- 2 How to fill Form 15G? (Filled Form 15G Sample)

- 2.1 Declaration/Verification

- 2.2 Part II of Form 15G/15H

- 3 How to Fill Form 15H? (Form 15H Sample)

- 4 Submitting Form 15G & Form 15H Online

- 5 Penalty for False Declaration on 15G/H

- 6 Form 15G & Form 15H – Important Points

- 7 To conclude

Who can submit Form 15G and Form 15H?

Form 15H is meant for senior citizens while Form 15G is meant for all other individuals and HUFs.

Form 15G eligibility

- You are individual below 60 years of age or a HUF

- You must be Indian resident

- The total interest income for the financial year is less than the minimum tax exemption limit for the year. For FY 2020-21 this limit is Rs 2.5 lakhs.

- The total tax calculated after taking all the deductions and exemptions is NIL for the financial year.

Form 15H eligibility

- Your age is 60 years or more

- You must be Indian resident

- The total tax calculated after taking all the deductions and exemptions is NIL for the financial year.

- The figure below gives example when people are eligible to file Form 15G/H.

Scenarios when you can or cannot fill Form 15G or Form 15H

The figure below gives some examples to check the eligibility to fill Form 15G and Form 15H.

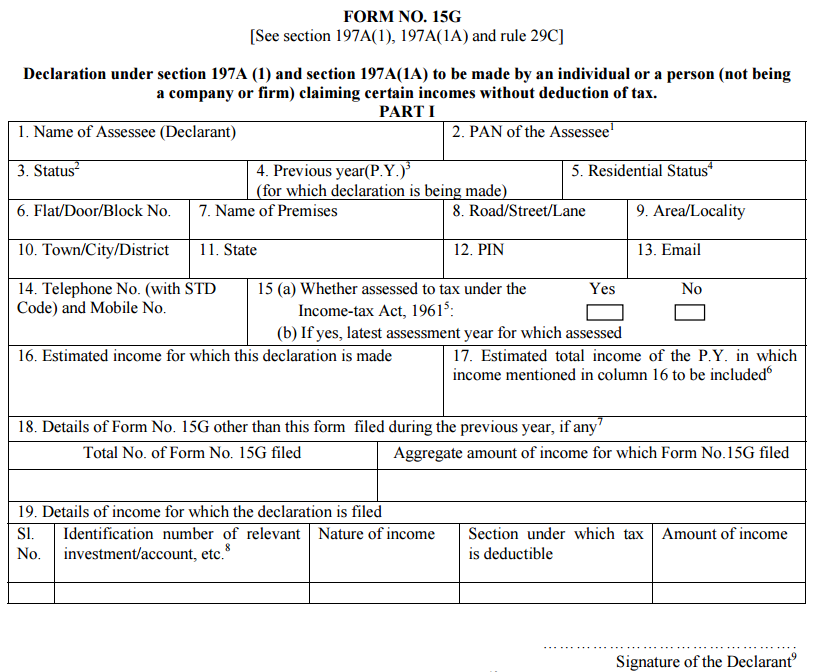

How to fill Form 15G? (Filled Form 15G Sample)

There are 19 fields to be filled in the Form. I really wonder why Government department makes forms so complicated and use such technical field names.

First Download Form 15G and Form 15H. You can also refer to your banks site to download these forms.

The form refers "Assessee" everywhere. Assessee refers to the name of the person on whose name the investment has been done.

Also it mentions "Previous Year" frequently. This confuses many people. Previous Year means financial year (i.e. April 1 to March 31)

The numbers below represent field names in the above form

1. Your name as it appears in PAN card

2. Your PAN number

3. Status – Write Individual or HUF as applicable

4. Previous Year is same as financial year. For e.g. you are making declaration for FY 2018-19 (i.e. for April 1, 2018 to March 31, 2019), the previous year field would be FY 2018-19.

5. Residential Status – Resident Indian or NRI. Only resident Indians are eligible to fill form 15G/H.

6 to 12 – Your current address details

13 – Your email address

14 – Telephone Number (with STD Code) and Mobile No. – Fill up both the numbers of whatever you have

15(a). Whether assessed to tax under the Income-tax Act, 1961. Yes or No – Mention 'Yes' if you have filed income tax return in last 6 financial years.

15(b). If yes, latest assessment year for which assessed – Mention the latest assessment year in which you filed your Income Tax return. (Assessment year is one year next to financial year For e.g. For FY 2018-19, the AY would be 2019-20)

23 Most common Investments and How they are Taxed in 2021?

Taxes eat a large chunk of returns that we make on investments. Keeping this in mind we have compiled list taxes applicable for most common investments in India. We cover everything from fixed deposit to stock markets to real estate.

16. Estimated income for which this declaration is made – This income is for the investment you are giving declaration. For e.g. you have FD of Rs 1 lakh at 7% interest for 1 Year, your estimated income for the financial year would be Rs 7,000.

17. Estimated total income of the P.Y. in which income mentioned in column 16 to be included – Total income expected in the financial year for which the declaration is being made. This would include the income declared in Field 16.

18. Details of Form No. 15G other than this form filed during the previous year, if any

- Total No. of Form No. 15G filed – Give the number of Form 15G you have submitted before this form

- Aggregate amount of income for which Form No. 15G filed – Total income for which Form 15G has been filed.

19. Details of income for which the declaration is filed – Mention the details of the investment for which the form is being submitted.

- Sl. No.

- Identification number of relevant investment/account, etc.

- Nature of income

- Section under which tax is deductible

- Amount of income

For e.g. For the above example of SBI fixed deposit you need to fill as follows:

- Sl. No. – 1

- Identification number of relevant investment/account, etc. – FD Account number

- Nature of income – Income from Interest

- Section under which tax is deductible – 194A

- Amount of income – Rs 7,000

I wonder how I-T department expects everyone to know income tax sections. Below are common sections for your reference:

| Investment | Income Tax Section | Cut Off (Rs.) | TDS when Valid PAN submitted | PAN not submitted |

| Bank – Fixed/Recurring Deposits | 194A | 10,000 | 10% | 20.00% |

| Premature withdrawal from EPF | 192A | 30,000 | 10% | 34.61% |

| Interest on securities | 193 | – | 10% | 20.00% |

| Dividends | 194 | 2,500 | 10% | 20.00% |

| Interest other than interest on securities – Others (NCDs, etc) | 194A | 5,000 | 10% | 20.00% |

Should you Invest in Gold?

We looked at more than 55 years history of gold to see if its a good idea to invest in Gold. We concluded that its more volatile than perceived but investing in long term may provide you with more stable returns. You can look at the complete analysis and our conclusion here – Looking at Gold Price History in India – Should you Invest in Gold?

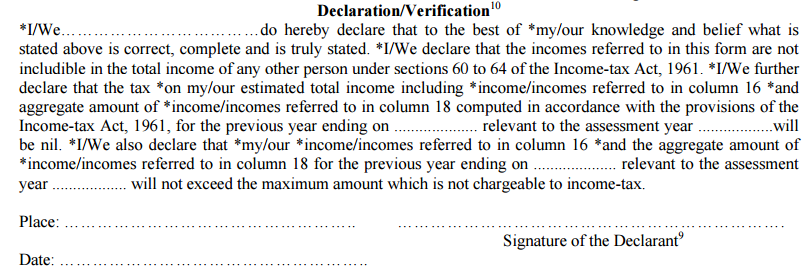

Declaration/Verification

Fill the date, place and Sign on the dotted lines.

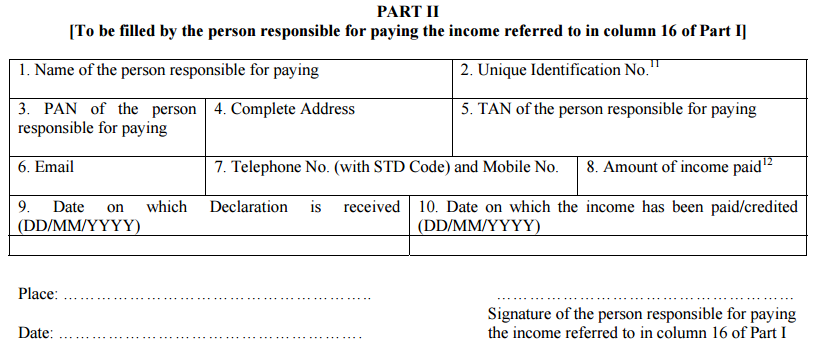

Part II of Form 15G/15H

This part has to be filled by the person responsible for paying the income referred to in column 16 of Part I.

Do you Know about Hidden Charges in Banks?

Do you know you pay a few thousand rupees every year to hidden charges of banks. This could range from more known fines for not maintaining minimum balance amount to lesser know POSDEC charge of ICICI Bank. There could be charges for ATM usage, branch visits, cheque books and so on. Do read our article on Hidden Charges in Banks and what you can do about it?

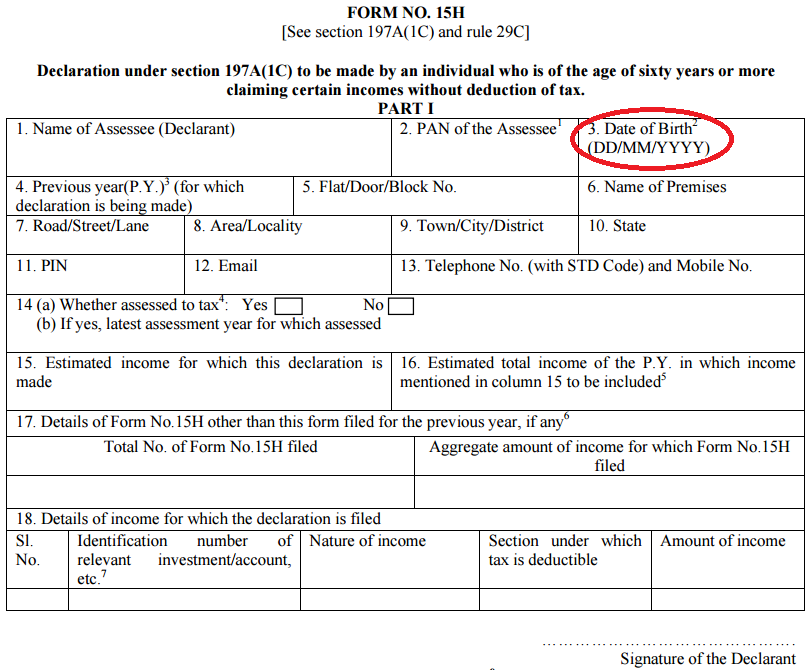

How to Fill Form 15H? (Form 15H Sample)

All the fields are similar to the Form 15G except Date of Birth (Field No 3).

How to generate Regular Monthly Income?

There can be several situations when we look for regular income. This is especially true for people after retirement without any pension. Also there would be new entrepreneurs who need regular income until their start-up stabilises. We tell you13 investments which can generate regular income for you along with their pros and cons.

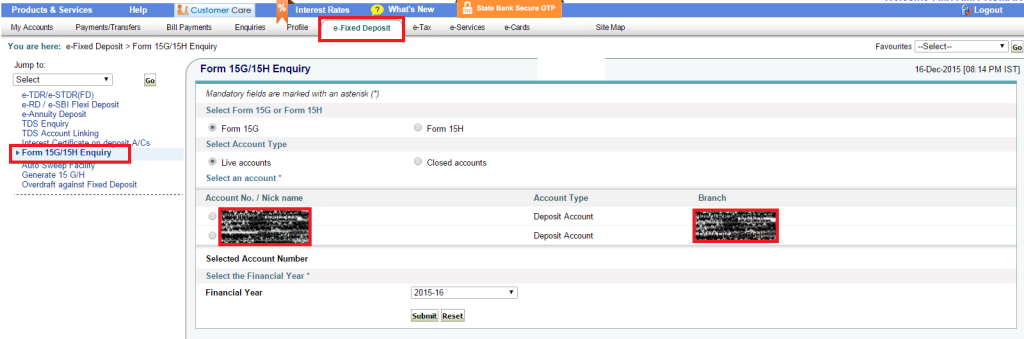

Submitting Form 15G & Form 15H Online

Some banks have allowed submission of Form 15G & Form 15H Online through internet banking. The screen shot below is from SBI and shows the links to be clicked for generating the form online.

Penalty for False Declaration on 15G/H

If you are not eligible to file Form 15G or Form 15H, you should not do so just to evade TDS. Providing false declaration can lead to fine and imprisonment u/s 277

- For tax evasion of more than Rs 1 Lakhs, there can be rigorous imprisonment for 6 months to 7 years along with fine

- For all other cases, there can be rigorous imprisonment for 3 months to 3 years along with fine.

Senior Citizens' Savings Scheme: An Excellent Investment

Senior Citizens' Savings Scheme or SCSS is an excellent investment for senior citizens for regular income and tax saving u/s 80C. It is 100% safe as its backed bu Government of India, the interest paid is generally higher than bank fixed deposits and the investment is eligible for tax saving u/s 80C. We explain the eligibility, process and do's & don'ts of SCSS in this post.

Form 15G & Form 15H – Important Points

- You need to submit the declaration at the start of every financial year to all the banks, companies where you have fixed deposits or recurring deposits.

- Always attach copy of PAN card while submitting the form.

- In case of joint accounts, the form should be submitted by the first account holder.

- The forms need to be submitted in all branches where you have investments. For e.g. If you have opened FD in 3 branches of ABI, you need to submit the above from in all 3 branches separately.

- Form 15G/H is just to prevent the hassle of TDS and later seeking refund. You would need to file income tax return if you so mandated by law.

- Do not submit Form 15G/H if you are not eligible to do so. It would create more problems than solve.

To conclude

The Form 15G and Form 15H was revised from October 1, 2015 and has been simplified. Also the reporting to income tax department has become more robust. You must fill these forms and submit to relevant banks/institutions only if you are eligible. Do not make a false declaration as that might create problems.

How To Fill 15h Form For Fixed Deposit Sample

Source: https://www.apnaplan.com/how-fill-form-15g-15h/

Posted by: eastonboung1938.blogspot.com

0 Response to "How To Fill 15h Form For Fixed Deposit Sample"

Post a Comment